Discover High-Yield, Hands-Off UK Property Investment

Our Property-Backed Loan Notes offer a smarter, hands-off investment alternative for sophisticated investors and High Net Worth Individuals (HNWI). By choosing this investment route over traditional buy-to-let (BTL), you eliminate the burdens associated with direct property ownership, such as maintenance, tenant management, and chasing payments.

This fixed-term, fixed-return structure inherently removes the need to worry about typical property transaction costs for the investor, such as Stamp Duty Land Tax (SDLT) or legal fees. Furthermore, investors benefit from focusing solely on the attractive returns offered.

““Backed by an award-winning UK developer (set. 2019) with 650+ properties delivered nationwide, we’ve returned over £30 million to investors with a 100% track record of interest and capital repayments””

Robust Security and Proven Expertise

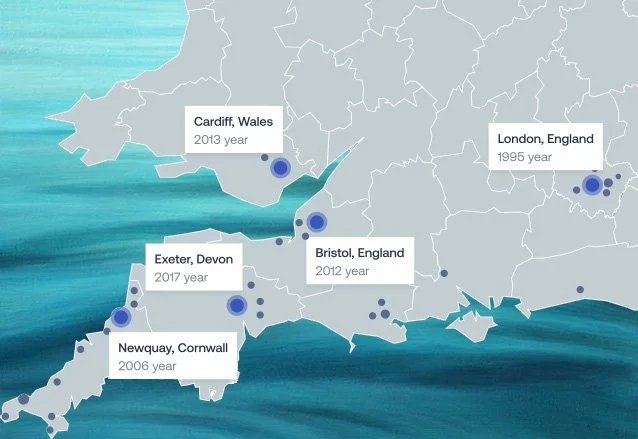

This unique opportunity is offered by a leading, multi-award-winning UK developer. Established in 2019, this fast-growing, nationwide property specialist has been recognised as "Property Developer of the Year" for three consecutive years.

The developer specialises in converting unloved commercial buildings into high-quality residential units, contributing directly to the nation's housing solutions. Their strategic approach has resulted in involvement with over 650 residential units and a Gross Development Value (GDV) exceeding £100 million.

| Term Options | |

| Name: | 1 Year - Income |

| Annual Rate of Return: | 7% |

| Payments Made: | Quarterly |

| Term Options | |

| Name: | 1 Year - Growth |

| Annual Rate of Return: | 8% |

| Payments Made: | End of Term |

| Term Options | |

| Name: | 3 Year - Income |

| Annual Rate of Return: | 11% |

| Payments Made: | Quarterly |

| Term Options | |

| Name: | 3 Year - Growth |

| Annual Rate of Return: | 13% |

| Payments Made: | End of Term |

| Term Options | |

| Name: | 5 Year - Income |

| Annual Rate of Return: | 12% |

| Payments Made: | Quarterly |

| Term Options | |

| Name: | 5 Year - Growth |

| Annual Rate of Return: | 15% |

| Payments Made: | End of Term |

Track Record and Returns

Our developer boasts a proven track record of success. They have already returned over £20 million to

Investors.

Investors seeking income or growth can expect attractive returns, with options providing up to 15% passive income per year. Investment terms are fixed for 1-year, 3-year or 5-year. Crucially, your investment is UK asset-backed and secured via a debenture over the Special Purpose Vehicles (SPVs) that hold the properties, providing a layer of security.